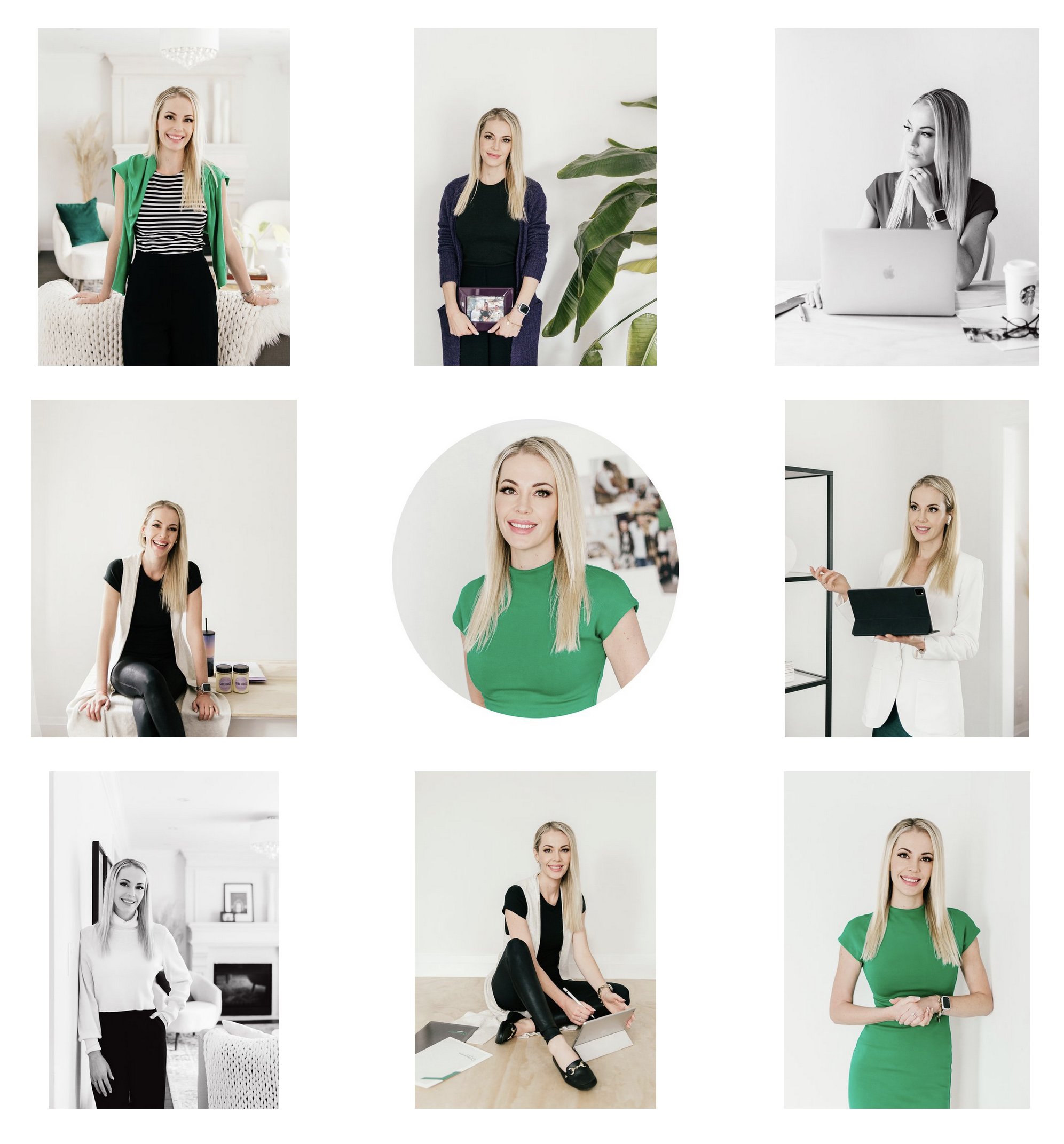

There's no question that

great wardrobe = great photoshoot

People ask me all the time: what should I wear for my photoshoot?

Great wardrobe doesn't mean designer only wardrobe.

Great photoshoot wardrobe is wardrobe that is authentic to you

and compliments your look well.

Check out these Iconic Outfits:

neutrals

Beige, taupe and other neautrals are having their moment, effortlessly replacing the classic white.

Neutrals exude sophistication while keeping the attention on you—not just your outfit. They create a clean, polished look that stands the test of time.

Want to elevate it? Play with layers, subtle patterns, and rich textures to add depth without distraction.

2. dress

Dresses are often overlooked and they can be a great Brand Photoshoot outfit. There are so many styles, silhuettes and colours available.

For more conservative professionals, you can wear a dress with sleeves or combine it with a blazer.

3. turtleneck

Turtlenecks frame our faces beautifully, which works perfectly for photos.

Depending on the fabric and sleeve length, you can wear them all seasons.

4. jeans

Jeans never go out of style and they help with approachable looks.

If it's approprate for your profession, bring jeans + top to your Brand Photoshoot! For business casual looks, jeans can be combined with blazers and shirts or blouses.

5. suit

A well tailored suit will make you feel unstoppable.

For more approachable looks, choose creative styles or bold colours.

6. black

Black - everybody’s favourite!

Black outfits are always elegant. Whether it’s a sweater, a blazer or a little black dress, feel free to bring something black to your photoshoot.

7. colour

Bold hues are stepping into the spotlight, bringing energy and personality to your photos.

Wearing colour can make a statement while still keeping the focus on you. The right shade can enhance your features, complement your skin tone, and add vibrancy to your look.

Want to take it up a notch? Experiment with colour blocking, rich jewel tones, or soft pastels to create depth and visual interest.

8. your logo/hashtag

Your Brand Photoshoot is a perfect chance to wear an outfit with your logo or hashtag.

These photos are absolutely great for marketing and building brand awareness.

9. creative top

Creative tops are so fun to photograph and make photos interesting to look at.

Remember to skip thick cotton blouses and choose a flowy fabric instead.

10. WOW Factor outfit

Photoshoots don’t happen every day, so take this chance and wear your WOW Factor outfit.

Whether it’s a tulle skirt, an incredible dress, leather pants, take this chance to capture your authentic, fierce self!

bonus: can I wear a sweater?

If you don’t want the photos to be too seasonal, choose a sweater that’s not too chunky and doesn’t have an obvious winter pattern.

If you want to use the photos only in fall/winter, you can wear whatever sweater you want.

Are you an Entrepreneur over 40 ready to step into your power? This photoshoot is for you: